edbl_s1.htmAs filed with the Securities and Exchange Commission on November 1, 2021

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

| EDIBLE GARDEN AG INCORPORATED |

| (Exact name of registrant as specified in its charter) |

| Delaware | | 100 | | 85-0558704 |

| (State or other jurisdiction of incorporation or organization) | | (Primary standard industrial classification code number) | | (I.R.S. employer identification number) |

283 County Road 519

Belvidere, NJ 07823

(908) 750-3953

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

James E. Kras

Chief Executive Officer

283 County Road 519

Belvidere, NJ 07823

(908) 750-3953

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Alexander R. McClean, Esq. Margaret K. Rhoda, Esq. Harter Secrest & Emery LLP 1600 Bausch & Lomb Place Rochester, NY 14604 Tel: (585) 232-6500 Fax: (585) 232-2152 | | Mitchell Nussbaum, Esq. Angela M. Dowd, Esq. Loeb & Loeb LLP 345 Park Avenue New York, NY 10154 Tel: (212) 407-4000 Fax: (212) 407-4990 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| | | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Security Being Registered(1) | | Proposed Maximum Aggregate Offering Price(2) | | | Amount of Registration Fee | |

| Common stock, par value $0.0001 per share | | $ | 86,250,000 | | | $ | 7,996 | |

| Representative’s warrants to purchase common stock(3) | | | – | | | | – | |

| Common stock underlying representative’s warrants(4) | | | 6,641,250 | | | | 616 | |

| Total | | $ | 92,891,250 | | | $ | 8,612 | |

__________

| (1) | Pursuant to Rule 416 under the Securities Act, the securities being registered hereunder include such indeterminate number of additional shares of common stock as may be issued after the date hereof as a result of stock splits, stock dividends or similar transactions. |

| | |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended (the “Securities Act”) and includes shares of common stock that may be issued upon exercise of a 45-day option granted to the underwriters to cover over-allotments, if any. |

| | |

| (3) | In accordance with Rule 457(g) under the Securities Act, because the registrant’s shares of common stock underlying the representative’s warrants are registered hereby, no separate registration fee is required with respect to the warrants registered hereby. |

| | |

| (4) | The representative’s warrants are exercisable for a number of shares of common stock equal to 4.0% of the number of shares of common stock sold in this offering, excluding upon exercise of the option to purchase additional securities, at a per share exercise price equal to 125% of the public offering price. The representative’s warrants are exercisable commencing six months immediately following the closing of this offering for a period of five years after the closing of this offering, at any time, and from time to time, in whole or in part. As estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act. Resales of shares of common stock issuable upon exercise of the representative’s warrants on a delayed or continuous basis pursuant to Rule 415 under the Securities Act are also registered hereby. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | | SUBJECT TO COMPLETION, DATED NOVEMBER 1, 2021 |

[___] Shares of

Common Stock

EDIBLE GARDEN AG INCORPORATED

This is an initial public offering of our shares of common stock. We are offering on a firm commitment basis, shares of common stock, $0.0001 par value per share (“common stock”). The initial public offering price per share of common stock is expected to be between $____ and $______.

Prior to this offering, there has been no public market for our common stock. We have applied to list our common stock on the Nasdaq Capital Market under the symbol “EDBL.” No assurance can be given that our application will be approved. If our application is not approved or we otherwise determine that we will not be able to secure the listing of our common stock on the Nasdaq Capital Market, we will not complete this offering.

We are an “emerging growth company,” as defined under the federal securities laws and, as such, we have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. See “Prospectus Summary — Implications of Being an Emerging Growth Company and Smaller Reporting Company.”

Investing in our securities is speculative and involves a high degree of risk. You should carefully consider the risk factors beginning on page 7 of this prospectus before purchasing our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | Per Share | | | Total | |

| Public offering price | | $ | | | | $ | | |

| Underwriting discounts and commissions(1) | | | | | | | | |

| Proceeds to us, before expenses | | | | | | | | |

____________

| (1) | We have also agreed to issue warrants to purchase shares of common stock to the representative of the underwriters and reimburse the underwriters for certain expenses in connection with this offering. See “Underwriting” for additional information regarding total underwriting compensation, including information on underwriting discounts and offering expenses. |

We have granted the representative of underwriters an option to purchase from us, at the public offering price, up to additional shares of common stock, less the underwriting discounts and commissions, within 45 days from the date of this prospectus to cover over-allotments, if any. If the representative of the underwriters exercises the option in full, the total underwriting discounts and commissions payable will be $ , and the total proceeds to us, before expenses, will be $ .

The underwriters expect to deliver the shares of common stock to purchasers on or about ________, 2021.

Sole Book-Running Manager

Maxim Group LLC

The date of this prospectus is _________, 2021

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus and in any free writing prospectus. We and the underwriters have not authorized anyone to provide you with information different from that contained in this prospectus. We and the underwriters are offering to sell, and seeking offers to buy, our securities only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our securities.

Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our securities and the distribution of this prospectus outside of the United States.

We own or have rights to trademarks or trade names that we use in connection with the operation of our business, including our corporate names, logos and website names. In addition, we own or have the rights to copyrights, trade secrets and other proprietary rights that protect the content of our products. This prospectus may also contain trademarks, service marks and trade names of other companies, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this prospectus is not intended to, and should not be read to, imply a relationship with or endorsement or sponsorship of us. Solely for convenience, some of the copyrights, trade names and trademarks referred to in this prospectus are listed without their ©, ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our copyrights, trade names and trademarks. All other trademarks are the property of their respective owners.

| PROSPECTUS SUMMARY The following summary highlights information contained elsewhere in this prospectus and is qualified in its entirety by the more detailed information and financial statements included elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our securities. Before you decide to invest in our securities, you should read and carefully consider the following summary together with the entire prospectus, including our financial statements and the related notes thereto and the matters discussed in the sections in this prospectus entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Business.” Some of the statements in this prospectus constitute forward-looking statements that involve risks and uncertainties. See “Cautionary Note Regarding Forward-Looking Statements.” Our actual results could differ materially from those anticipated in such forward-looking statements as a result of certain factors, including those discussed in the “Risk Factors” and other sections of this prospectus. In this prospectus, unless otherwise stated or the context otherwise requires, references to “Edible Garden,” the “Company,” “we,” “us,” “our,” or similar references mean Edible Garden AG Incorporated and its subsidiaries on a consolidated basis. Our Company Edible Garden is a next generation controlled environment agriculture (“CEA”) farming company. We use traditional agricultural growing techniques together with technology to grow fresh, organic food, sustainably and safely while improving traceability. We use the controlled environment of traditional greenhouse structures, such as glass greenhouses, together with hydroponic and vertical greenhouses to sustainably grow organic herbs and lettuces. In our hydroponic greenhouse, we grow plants without soil. Instead of planting one row of lettuce in the ground, by using a vertical greenhouse, we can grow many towers of lettuce in the same area by planting up instead of planting across. Growing these products sustainably means that we avoid depleting natural resources in order to maintain an ecological balance, such as by renewing, reusing and recycling materials in order to lower the overall one-time use of materials. Our controlled greenhouse facilities allow us to grow consistent quality herbs and lettuces year-round, first by eliminating some of the variability of outdoor farming with our CEA techniques, and second by leveraging our proprietary software, GreenThumb. In addition to using hydroponic and vertical greenhouse systems, we use a “closed loop” system in our greenhouses. Generally, in a “closed loop” system, drain water is recollected and reused for irrigation. In our closed loop system, we also cycle water back into the system that has been collected through reverse osmosis. When compared to conventional agriculture, our closed looped systems and hydroponic methods use less land, less energy and less water (than legacy farms), thus conserving some of the planet’s limited natural resources. Our advanced systems are also designed to help mitigate contamination from harmful pathogens, including salmonella, e-coli and others. We have also developed patented software called GreenThumb that assists in tracking plants through our supply chain. Utilizing our GreenThumb software to track the status of our plants as they grow and move throughout the greenhouse allows us to add a layer of quality control due to the frequent monitoring of the growing process, leading to improved traceability. In this context, traceability means being able to track a plant through all stages of production and distribution. In addition to improving traceability, GreenThumb helps us better manage the day-to-day operations of our business. GreenThumb is a web-based greenhouse management and demand planning system that does the following: · integrates in real-time with our cloud business software suite for monitoring daily sales data; · generates reports by category, product, customer, and farm to allow us to analyze sales, trends, margins and retail shrink (spoiled product); · provides dynamic pallet mapping for packout, which enables us to more efficiently ship our products; · utilizes a proprietary algorithm that uses year-over-year and trending sales data to develop customer specific and aggregate product specific forecasting for our greenhouses; · aggregates all greenhouse activity input to provide real-time inventory and availability reports of all products in our greenhouses; · manages our online ordering system with user controlled product availability based upon greenhouse inventory; · provides a route management system for coordinating the logistics of our direct store delivery program; and · tracks all production activities at greenhouses, including sowing, spacing, dumping, spraying, picking and packing, using hand held devices. We also use our GreenThumb software to help monitor the quality of our products, and we have dedicated quality assurance and quality control personnel that check and monitor our products. We have customer service personnel that answer any questions the consumers of our products may have, and we regularly ask for feedback from our customers on the quality of our products. The combination of the GreenThumb software, quality assurance and control processes (including compliance with food safety standards), and feedback from consumers and purchasers holds us accountable for maintaining the quality of our herbs and lettuce. We focus our efforts on producing our herbs and vegetables in a sustainable manner that will reduce consumption of natural resources, by recycling water in our closed loop system and using LED lights instead of conventional lightbulbs to accelerate crop growth and yield, when necessary. In addition, the inventory management component of GreenThumb allows us to manage inventory levels, order quantities and fill rates while maximizing truck loads. This means that we are better able to control shipping our products in full truck loads, thus eliminating multiple deliveries and decreasing the excess emission of greenhouse gases that would result from many partially full trucks delivering our products. Together, these elements of our production and distribution process are intended to reduce our carbon footprint, or the total amount of greenhouse gases that are generated by our actions, as compared to a legacy farm business. We believe our focus on our brand “Edible Garden” is a significant differentiator. The brand not only lends itself to our current portfolio of products but allows us to develop other products in the “Consumer Brands” category. Our focus on sustainability, traceability, and social contribution, which we define as an ongoing effort to improve employee relations, working conditions, and local communities, presents our value proposition to our customers and supermarket partners and distributors.

|

| We believe that Edible Garden’s state-of-the-art facilities comply with food safety and handling standards. We have food safety certifications from Primus GFS (“Primus”), a Global Food Safety Initiative (“GFSI”) certification program, the United States Department of Agriculture (“USDA”) for organic products (“USDA Organic”), and some of our products are verified as non-genetically modified (“non-GMO”) by the non-GMO Project. We are licensed under the Perishable Agricultural Commodities Act (“PACA”) to operate our business. We voluntarily comply with the Hazard Analysis Critical Control Point (“HACCP”) principles established by the United States Food and Drug Administration (“FDA”). See “Business — Overview” for more information about our certifications, license and the standards we follow. We intend to use our approach to expand in key strategic markets across the country while supporting our existing operations. Our priority in the near term is to strengthen our existing business in part with the proceeds from this offering. We have a history of operating losses since inception and expect to incur additional near-term losses. As discussed further in “Management’s Discussion and Analysis — Liquidity and Capital Resources,” our auditors have issued an opinion that there is a substantial doubt about our ability to continue as a going concern if we are unable to complete this offering. However, we are pursuing this offering because we believe that we have the potential to take advantage of strategic growth opportunities. Our model of growing local produce near high population density centers and being able to provide fresh produce to our existing supermarket partners, who have a wider network than us, is intended to create organic growth in our business through those existing relationships. If we complete this offering, we intend to use part of the proceeds to either build or acquire greenhouses near population centers and distribution centers to be able to grow more produce close to where it is in demand and to deepen our relationships with regional and national supermarkets. Our model allows us to reduce transportation food miles, reduce fuel costs, and lower emissions related to food transportation. It is our strong belief that the power of our brand together with the quality, innovative packaging and traceability of our products allow all of our customers to associate Edible Garden with locally grown and sustainably sourced packaged herbs and vegetables. Our tag line “Simply Local, Simply Fresh” is intended to describe our business plan: growing herbs and lettuce in local farms in the regional communities where our customers sell our products so that the products stay fresher for longer. We believe this strategy allows us to drive local grass roots brand awareness while we grow our business to support our plan to become a national brand. |

| We currently offer 31 stock keeping units “SKU’s” and expect to further cross sell products across our supermarket partners to meet their demand. These products include: |

| | | |

| | · | 10 types of individually potted, live herbs; |

| | · | 10 types of cut single-herb clamshells; |

| | · | 2 specialty herb items; |

| | · | 6 different types of lettuce; |

| | · | hydro basil; |

| | · | bulk basil; and |

| | · | vegan protein powder. |

| | | |

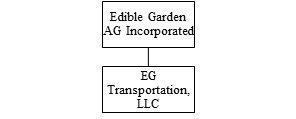

| We currently sell our products to a number of regional and national supermarkets. Since inception, a few of our customers constituted a majority of our total revenue. For example, during the six months ended June 30, 2021, we earned approximately 58% of our revenue from two customers, and we earned approximately 34% of our revenue from one customer in the period from our inception through December 31, 2020. While we value our strong relationship with these major customers, we face the risk of losing a significant source of revenue if our major customers do not continue to purchase our products. If that were to occur and we were unable to replace the revenue by selling our products to additional customers, our ability to earn revenue would be significantly negatively impacted. Part of our growth strategy is to reduce this customer concentration by expanding our production capacity, which would allow us to sell our products to more supermarket partners. Corporate History and Structure Our business is a successor business of Terra Tech Corp. (now known as Unrivaled Brands, Inc.)(“Terra Tech”). We purchased substantially all of the assets of Edible Garden Corp., a subsidiary of Terra Tech, from Terra Tech as of March 30, 2020. Our company was incorporated on March 28, 2020 in the State of Wyoming as Edible Garden Inc. We subsequently changed our name to Edible Garden AG Incorporated on July 20, 2020. Effective July 7, 2021, our parent company, Edible Garden Holdings Inc., merged with and into us with us as the surviving entity. We converted into a Delaware corporation effective July 12, 2021. We have one wholly-owned subsidiary, EG Transportation, LLC, through which we manage the distribution of our products. Our current corporate structure is as shown below:

The outstanding common stock of our company is currently held by only a few individuals and one entity. An affiliate of Terra Tech, Sament Capital Investments, Inc. (“Sament”) owns 20.0% of our outstanding shares of common stock and is one of our creditors. Our executive officers collectively own 71.2% of our outstanding shares of common stock. As a result, our executive officers are able to exercise a significant level of control over all matters requiring stockholder approval. Our executive officers and Sament have significant influence over our business strategies and would have the ability to delay or prevent a change of control of our company or other significant corporate transactions. Our principal address is 283 County Road 519, Belvidere, NJ 07823. Our telephone number is (908) 750-3953. We maintain a website at www.ediblegarden.com. The information contained on our website is not, and should not be interpreted to be, incorporated into this prospectus. Recent Developments Private Placement On October 7, 2021, we closed on a private placement with Evergreen Capital Management LLC (“Evergreen”) and raised $1.0 million, which we intend to use to support our working capital requirements. In the private placement, we issued a 15% original issue discount secured promissory note to Evergreen (the “Evergreen Note”) and a warrant to purchase 751,623 shares of our common stock (the “Evergreen Warrant”). The Evergreen Note matures on July 7, 2022 and incurs interest at a rate of 5.0% per annum. The Evergreen Note is secured and subordinated to the notes held by Sament. Evergreen may elect to convert the Evergreen Note into shares of common stock at a conversion price of $1.53 per share. If the Evergreen Note is not converted into shares of common stock prior to the closing of this offering, we intend to repay the amount due under the Evergreen Note with some of the proceeds of this offering. The Evergreen Warrant may be exercised for the underlying shares of common stock at an exercise price of $1.53 per share until October 7, 2026. As part of the private placement, Maxim Group LLC, the representative of the underwriters in this offering, received a cash fee equal to 6% of the private placement proceeds. We have the option to issue up to $1.0 million in additional notes and warrants to Evergreen before January 10, 2022. The offering was conducted pursuant to an exemption from registration under the Securities Act of 1933, as amended (the “Securities Act”) in reliance upon Rule 506(b) promulgated under the Securities Act. Exercise of Options by Sament On October 8, 2021, Sament exercised its option to purchase 5,000,000 shares of our common stock for an aggregate exercise price of $2.00. Listing on the Nasdaq Capital Market There is currently no public trading market for our shares of common stock. In connection with this offering, we have applied to list our common stock on the Nasdaq Capital Market (“Nasdaq”) under the symbol “EDBL.” If our listing application is approved, we expect to list our common stock on Nasdaq upon consummation of the offering. No assurance can be given that our listing application will be approved or that our common stock will be listed on Nasdaq. This offering will occur only if Nasdaq approves the listing of our common stock. Summary Risk Factors Our business is subject to a number of risks and uncertainties that you should understand before making an investment decision. These risks are discussed more fully in the section entitled “Risk Factors” following this prospectus summary. These include: |

| | | |

| | · | our history of losses and the substantial doubt about our ability to continue as a going concern, which could cause our stockholders to lose some or all of their investment in us; |

| | · | our ability to continue to access and operate our Belvidere, New Jersey facility, since we are operating the property through an arrangement with our predecessor and the lessor instead of a lease; |

| | · | our ability to raise additional capital in this offering or through additional offerings, which may not be available on favorable terms, if at all, and without which we may not be able to continue as a going concern; |

| | · | our relatively short operating history; |

| | · | the concentration of our revenue among a few customers and the risks of losing one of those customers; |

| | · | the existence of a material weakness in our internal control over financial reporting; |

| | · | the impact of any general and regional economic volatility or economic downturn; |

| | · | our reliance on our management team and our ability to attract, train and retain qualified personnel; |

| | · | the impact of any labor shortage or external price increases; |

| | · | implementing any new lines of business or offering new products; |

| | · | the impact of reputational damage; |

| | · | the impact of product contamination or product liability claims; |

| | · | our ability to protect our intellectual property rights; |

| | | |

| | · | the impact of cyber-attacks or security breaches; |

| | · | our ability to maintain the necessary permits and compliance with regulations and requirements as a producer and distributor of food products; |

| | · | our ability to properly use hydroponic farming methods; |

| | · | fluctuation in the market price and demand for agricultural products; |

| | · | seasonality; |

| | · | increases in the cost of commodities or raw product inputs; |

| | · | our ability to comply with government policies and regulations specifically affecting the agricultural sector; |

| | · | our ability to compete in our industry; |

| | · | the immediate and substantial dilution investors in this offering will experience; |

| | · | the broad discretion of our management team to apply the net proceeds of this offering; |

| | · | the concentration of ownership among related parties, including existing executive officers and directors; |

| | · | our status as an emerging growth company and a smaller reporting company; |

| | · | our expectation that we will not declare dividends to our stockholders in the foreseeable future; |

| | · | the potentially dilutive impact of seeking additional funds; |

| | · | the public offering price in this offering was determined between us and the underwriter; |

| | · | the potential impact of shares of common stock available for future sale after this offering; |

| | · | a possible “short squeeze” due to a sudden increase in demand of our shares of common stock leading to price volatility; |

| | · | our certificate of incorporation and bylaws could discourage a change in control or acquisition of us by a third party; and |

| | · | the impact of the COVID-19 pandemic on our business. |

| | | |

| Implications of Being an Emerging Growth Company and Smaller Reporting Company We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements that are applicable to other companies that are not emerging growth companies. Accordingly, we have included detailed compensation information for only our three most highly compensated executive officers and have not included a compensation discussion and analysis of our executive compensation programs in this prospectus. In addition, for so long as we are an “emerging growth company,” we will not be required to: |

| | | |

| | · | engage an auditor to report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”); |

| | · | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board (“PCAOB”) regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; |

| | · | comply with new or revised accounting standards applicable to public companies as quickly as other public companies; |

| | · | submit certain executive compensation matters to stockholder advisory votes, such as “say-on-pay,” “say-on-frequency,” and “say-on-golden parachutes;” or |

| | · | disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparison of the chief executive officer’s compensation to median employee compensation. |

| | | |

| In addition, the JOBS Act provides that an “emerging growth company” can use the extended transition period for complying with new or revised accounting standards. We will remain an “emerging growth company” until the earliest to occur of: |

| | | |

| | · | our reporting $1.07 billion or more in annual gross revenues; |

| | · | our issuance, in a three-year period, of more than $1 billion in non-convertible debt; |

| | · | the end of the fiscal year in which the market value of our common stock held by non-affiliates exceeds $700 million on the last business day of our second fiscal quarter; and |

| | · | December 31, 2026. |

| | | |

| We cannot predict if investors will find our securities less attractive because we may rely on these exemptions, which could result in a less active trading market for our securities and increased volatility in the price of our securities. Finally, we are a “smaller reporting company” (and may continue to qualify as such even after we no longer qualify as an emerging growth company) and accordingly may provide less public disclosure than larger public companies, including the inclusion of only two years of audited financial statements and only two years of management’s discussion and analysis of financial condition and results of operations disclosure. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests. |

| | | |

| | | |

| THE OFFERING |

| | | |

| Issuer: | | Edible Garden AG Incorporated |

| Common stock being offered by us: | | shares (or shares of common stock if the underwriters exercise their over-allotment option in full). |

| Assumed public offering price: | | $ per share, which is the mid-point of the price range indicated on the cover page of this prospectus. |

| Common stock outstanding immediately prior to this offering: | | shares |

| Common stock to be outstanding immediately after this offering: | | shares(1) (or shares of common stock if the underwriters exercise their over-allotment option in full), including shares issuable upon conversion of our Series 2020 Crowd SAFEs, the Evergreen Note and convertible notes held by our Messrs. Kras and James, our Chief Executive Officer and Chief Financial Officer. |

| Over-allotment option: | | We have granted the underwriters an option, exercisable for 45 days after the date of this prospectus, to purchase up to an additional shares of common stock at the public offering price less the underwriting discounts payable by us, solely to cover over-allotments, if any. |

| Use of proceeds: | | We intend to use the net proceeds from this offering for the construction and/or acquisition of existing greenhouses, working capital, organizational build out, including the hiring of a chief operating officer, chief marketing officer, head of sales, and support and operational staff, debt repayment, transaction bonuses for our executive officers and general corporate purposes. See “Use of Proceeds.” |

| Representative’s warrants: | | Upon the closing of this offering, we will issue to Maxim Group LLC or its designee, as the representative of the underwriters in this offering, warrants entitling it to purchase a number of shares of common stock equal to 4.0% of the shares of common stock sold in this offering at an exercise price equal to 125% of the public offering price in this offering (the “Representative’s Warrants”). The Representative’s Warrants shall be exercisable commencing six months after the closing of this offering and will expire five years after the effective date of the registration statement of which this prospectus forms a part. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the Representative’s Warrants. |

| Underwriter compensation: | | The underwriter will receive an underwriting discount equal to 7.0% of the gross proceeds from the sale of securities in the offering. We will also reimburse the underwriter for certain out-of-pocket actual expenses related to the offering. See “Underwriting.” |

| Proposed Nasdaq trading symbol: | | We have applied to have our common stock listed on Nasdaq under the symbol “EDBL.” No assurance can be given that the listing will be approved or that a trading market will develop for the common stock. We will not complete this offering unless we receive approval for listing on Nasdaq. |

| Lock-up agreements: | | We and our directors, officers and the holders of 1.0% or more of the outstanding shares of our common stock have agreed with the representative not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our common stock or securities convertible into common stock for a period of 180 days after the closing of this offering. See “Underwriting—Lock-Up Agreements.” |

| Transfer agent and registrar: | | We are in the process of engaging a transfer agent and registrar for our common stock. |

| | | |

| Risk factors: | | The securities offered by this prospectus are speculative and involve a high degree of risk. Investors purchasing securities should not purchase the securities unless they can afford the loss of their entire investment. See “Risk Factors” beginning on page 7. |

| (1) | The number of shares of our common stock to be outstanding following this offering is based on 25,000,000 outstanding shares of common stock as of October 22, 2021, and excludes: |

| | | |

| | · | 751,623 shares of common stock issuable upon the exercise of a warrant held by Evergreen at an exercise price of $1.53 per share; |

| | | |

| | · | shares of our common stock issuable upon the exercise of the Representative’s Warrants to be issued in this offering. |

| |

| Unless otherwise indicated, this prospectus reflects and assumes that the following are not converted into or exercised for shares of our common stock: |

| | | |

| | · | 751,623 shares of common stock issuable upon the exercise of a warrant held by Evergreen at an exercise price of $1.53 per share; |

| | · | 753,200 shares of common stock issuable upon the conversion of the Evergreen Note; |

| | · | shares of our common stock issuable upon the exercise of the Representative’s Warrants to be issued in this offering; and |

| | · | no exercise by the underwriters of their option to purchase up to additional shares of our common stock from us to cover over-allotments, if any. |

RISK FACTORS

Investing in our common stock is highly speculative and involves a significant degree of risk. You should carefully consider the risks described below and elsewhere in this prospectus, which could materially and adversely affect our business, results of operations or financial condition. Our business faces significant risks and the risks described below may not be the only risks we face. Additional risks not presently known to us or that we currently believe are immaterial may materially affect our business, results of operations, or financial condition. If any of these risks occur, the trading price of our common stock could decline and you may lose all or part of your investment.

Risks Related to Our Business

We have a history of losses, expect to continue to incur losses in the near term and may not achieve or sustain profitability in the future, and as a result, our management has identified and our auditors agreed that there is a substantial doubt about our ability to continue as a going concern.

We have incurred significant losses since our inception. We have experienced net losses of approximately $2.081 million for the period March 28, 2020 (inception) through December 31, 2020 and $2.345 million in the six months ended June 30, 2021. We expect our capital expenses and operational expenses to increase in the future due to expected increased sales and marketing expenses, operational costs, and general and administrative costs and, therefore, our operating losses will continue or even increase at least through the near term. Furthermore, to the extent that we are successful in increasing our customer base, we will also incur increased expenses because costs associated with generating and supporting customer agreements are generally incurred up front, while revenue is generally recognized ratably over the term of the relationship. You should not rely upon our recent revenue growth as indicative of future performance. We may not reach profitability in the near future or at any specific time in the future. If and when our operations do become profitable, we may not sustain profitability.

The report of our independent registered public accounting firm that accompanies our audited consolidated financial statements contains a going concern qualification in which such firm expressed substantial doubt about our ability to continue as a going concern. Our consolidated financial statements do not include any adjustments that might result if we are unable to continue as a going concern. If we are unable to continue as a going concern, holders of our securities might lose their entire investment. Although we plan to attempt to raise additional capital through one or more private placements or public offerings, the doubts raised relating to our ability to continue as a going concern may make our shares an unattractive investment for potential investors. These factors, among others, may make it difficult to raise any additional capital and may cause us to be unable to continue to operate our business.

We currently operate our flagship facility pursuant to an arrangement with our predecessor and the lessor of the land instead of a lease.

We currently do not have a formal lease to the land on which our flagship facility, in Belvidere, New Jersey, is built. We are currently party to an ongoing arrangement with our predecessor company, Edible Garden Corp., whereby we make lease payments of approximately $15,300 per month to the lessor of the land on which our flagship facility is built and for which our predecessor company is the lessee. We do not have a lease in place directly with the lessor of the property that gives us the right to operate the property. Accordingly, we are subject to the risk that we will lose access to the property if the lessor were to evict us from the facility and property. If we were unable to access the property and continue operations in Belvidere, New Jersey, we may lose the ability to continue growing as great a quantity of herbs and lettuce and may be unable to continue our business. If those risks occur, you could lose the entire value of your investment in us.

We may need to raise capital in addition to this offering, which may not be available on favorable terms, if at all, and which may cause dilution to holders of our common stock, restrict our operations or adversely affect our ability to operate and continue our business.

If we need to raise additional funds due to unforeseen circumstances or material expenditures or if our operating results are worse than expected, we cannot be certain that we will be able to obtain additional financing on favorable terms, if at all, and any additional financings could result in additional dilution to holders of our common stock. Debt financing, if available, may involve agreements that include covenants limiting or restricting our ability to take specific actions such as incurring additional debt, expending capital, or declaring dividends, or which impose financial covenants on us that limit our ability to achieve our business objectives. If we need additional capital and cannot raise it on acceptable terms, we may not be able to meet our business objectives, our stock price may fall and you may lose some or all of your investment.

We have a relatively short operating history, which makes it difficult to evaluate our business and future prospects.

We have a relatively short operating history, which makes it difficult to evaluate our business and future prospects. While the predecessor business has existed since 2013, our company has been in existence only since March 2020. We have encountered, and will continue to encounter, risks and difficulties frequently experienced by growing companies in rapidly changing industries, including those related to:

| | · | market acceptance of our current and future products and services; |

| | · | changing regulatory environments and costs associated with compliance; |

| | · | our ability to compete with other companies offering similar products and services; |

| | · | our ability to effectively market our products and services and attract new customers; |

| | · | the amount and timing of expenses, particularly sales and marketing expenses, related to the maintenance and expansion of our business, operations and infrastructure; |

| | · | our ability to control costs, including our expenses; |

| | · | our ability to manage organic growth; and |

| | · | general economic conditions and events. |

If we do not manage these risks successfully, our business and financial performance will be adversely affected.

We earned approximately 58% of our revenue from two customers during the six months ended June 30, 2021 and approximately 34% of our revenue from one customer in the period from March 28, 2020 (inception) through December 31, 2020, and if we lose any of these customers or if we are unable to replace the revenue through the sale of our products to additional customers, our financial condition and results from operations would be materially and adversely affected.

During the six months ended June 30, 2021, two customers accounted for approximately 58% of our total revenue, and during the period from March 28, 2020 (inception) through December 31, 2020, one of our customers accounted for approximately 34% of our total revenue. This concentration of customers leaves us exposed to the risks associated with the loss of one or more of these significant customers, which would materially and adversely affect our revenues and results of operations. If these customers were to significantly reduce their relationship with us, or in the event that we are unable to replace the revenue through the sale of our products to additional customers, our financial condition and results from operations could be negatively impacted, and such impact would likely be significant.

The loss of one or more of the Company’s customers, or a reduction in the level of purchases made by these customers, could negatively impact the sales and profits of the Company.

The Company sells its products to national and local supermarket chains. If sales to one or more of the Company’s largest customers are reduced, this reduction may have a material adverse effect on the Company’s business and financial condition. These customers make purchase decisions based on a combination of price, product quality, consumer demand, customer service performance, desired inventory levels and other factors that may be important to them at the time the purchase decisions are made. Changes in these customers’ strategies or purchasing patterns may adversely affect the sales of the Company. For example, the customers may face financial or other difficulties, which may impact their operations and cause them to reduce their level of purchases, which could then adversely affect the Company’s results of operations. Any bankruptcy or other business disruption involving one of the Company’s significant customers also could adversely affect the results of operations as well.

Our relationships with customers are based on purchase orders rather than long-term purchase commitments.

We are subject to uncertainty because our relationships with customers are based on purchase orders rather than long-term purchase commitments. To ensure availability of our products, in some cases we start sowing our products in advance of receiving purchase orders for those products. Inaccuracies in our estimates of customer demand and product mix could negatively affect our ability to supply product to our customers and operating results. Our customers can cancel purchase orders or defer the shipments of our products under certain circumstances with little or no advance notice to us. If we grow more products than we are able to sell to our customers, we will incur losses and our results of operations and financial condition will be harmed.

Our secured indebtedness could have important consequences to you.

Our secured indebtedness could have important consequences to you. For example, it could:

| | · | limit our ability to obtain additional financing for working capital, capital expenditures, acquisitions and other general corporate requirements; |

| | | |

| | · | require us to dedicate a portion of our cash flow from operations to payments on our debt, thereby reducing the availability of our cash flow for operations and other purposes; |

| | | |

| | · | limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; and |

| | | |

| | · | place us at a competitive disadvantage compared to competitors that may have proportionately less debt and greater financial resources. |

Our secured indebtedness, held by Sament and Evergreen, is secured by a security interest in all of our assets. If we were to default on our obligations under the Sament Notes and Evergreen Note, Sament first, and then Evergreen, would have the right to our assets. We could be required to dispose of material assets or operations to meet our debt service and other obligations, and the value realized on such assets or operations will depend on market conditions and the availability of buyers. Accordingly, any such sale may not, among other things, be for a sufficient dollar amount. If we were to otherwise attempt to sell material assets or operations, the foregoing encumbrances may limit our ability to dispose of material assets or operations. In the event that Sament and Evergreen enforced their rights to our assets, we may have to discontinue our business, and our investors could lose all or a part of their investment in us.

We have a material weakness in our internal control over financial reporting, which if left unremediated could materially and adversely affect the market price of our common stock.

As of December 31, 2020 and June 30, 2021, we did not maintain effective controls over the control environment, including our internal control over financial reporting. Because we are a small company with few employees in our finance department, we lacked the ability to have adequate segregation of duties in the financial statement preparation process. Further, our Board of Directors does not currently have any independent members and no director qualifies as an audit committee financial expert as defined in Item 407(d)(5)(ii) of Regulation S-K. Since these entity level controls have a pervasive effect across the organization, management has determined that these circumstances constitute a material weakness. If we are unable to remediate this material weakness as a newly public company, our financial reporting may not be reliable and the market price of our common stock may be adversely affected.

The Company’s performance may be impacted by general and regional economic volatility or an economic downturn.

An overall decline in economic activity could adversely impact the Company’s business and financial results. Economic uncertainty may reduce consumer spending as consumers make decisions on what to include in their food budgets. Economic uncertainty could also result in changing consumer preference. Shifts in consumer spending could result in increased pressure from competitors or customers that may require the Company to increase promotional spending or reduce the prices of some products, which could then lower revenue and profitability.

Additionally, the Company is subject to regional economic volatilities since the Company’s growing operations are located in a few areas, including Belvidere, New Jersey; Half Moon Bay, California; Hilliard, Florida; Francesville, Indiana; Grand Rapids, Michigan; Berlin, New York; Cleveland, Ohio; and Hixton, Wisconsin. The Company’s use of hydroponic farming requires that it rely on local disease-free water sources and growing materials. Accordingly, any change in the availability of these local raw materials could adversely affect the Company’s operating results.

Our business would be adversely affected by the departure of members of our management team.

Our success depends, in large part, on the continued contributions of James E. Kras and Michael James. Although we have employment agreements in place for each of these executives, we cannot assure you that each will remain with us for a specified period. Although we have additional personnel that contribute to our business, the loss of either of these executives could harm our ability to implement our business strategy and respond to the rapidly changing market conditions in which we operate.

If we are unable to attract, train and retain qualified personnel, especially our management and sales personnel, we may not be able to effectively execute our business strategy.

Our future success depends on our ability to attract, retain and motivate qualified personnel, including our management, sales and marketing, operational, transportation, finance and administration personnel. For example, we currently have a limited number of personnel for our picking, packing and shipping group and greenhouse floor operations. We do not know whether we will be able to hire sufficient workers for these positions to meet our production goals or, if hired, retain all of these personnel as we continue to pursue our business strategy. The loss of the services of one or more of our key employees, or our inability to attract, retain and motivate qualified personnel could have a material adverse effect on our business, financial condition and operating results.

The costs of our operations may exceed our estimates due to factors outside of our control, such as labor shortages or external price increases, and we may be unable to pass those costs to our customers, which would negatively impact our financial results.

We depend on our employees and contracted grow operations teams to grow and distribute our products to our customers. We rely on access to competitive, local labor supply, including skilled and unskilled positions, to operate our business consistently and reliably. Any labor shortage, caused by the COVID-19 pandemic or other factors, and any disruption in our ability to hire workers would negatively affect our operations and financial condition. If we experience a sustained labor shortage, we may need to increase wages to attract workers, which would increase our costs of growing our products. Furthermore, if the prices of our raw materials, utilities or distributing our products were to increase, including due to inflationary pressures, we may be unable to pass those increased costs on to our customers. If we are unable to do so, our gross margin would decline, and our financial results would be negatively impacted.

We may implement new lines of business or offer new products and services within existing lines of business.

As an early-stage company, we may implement new lines of business at any time. There are substantial risks and uncertainties associated with these efforts, particularly in instances where the markets are not fully developed. In developing and marketing new lines of business and/or new products and services, we may invest significant time and resources. Initial timetables for the introduction and development of new lines of business and/or new products or services may not be achieved, and price and profitability targets may not prove feasible. We may not be successful in introducing new products and services in response to industry trends or developments in technology, or those new products may not achieve market acceptance. As a result, we could lose business, be forced to price products and services on less advantageous terms to retain or attract clients, or be subject to cost increases. As a result, our business, financial condition or results of operations may be adversely affected.

Damage to our reputation could negatively impact our business, financial condition and results of operations.

Our reputation and the quality of our brand are critical to our business and success in existing markets, and will be critical to our success as we enter new markets. Any incident that erodes consumer loyalty for our brand could significantly reduce its value and damage our business. We may be adversely affected by any negative publicity, regardless of its accuracy. Also, there has been a marked increase in the use of social media platforms and similar devices, including blogs, social media websites and other forms of internet-based communications that provide individuals with access to a broad audience of consumers and other interested persons. The availability of information on social media platforms is virtually immediate as is its impact. Information posted may be adverse to our interests or may be inaccurate, each of which may harm our performance, prospects or business. The harm may be immediate and may disseminate rapidly and broadly, without affording us an opportunity for redress or correction.

The Company is subject to risk of product contamination and product liability claims.

The sales of our products involve the risk of injury to consumers. Such injuries may result from tampering by unauthorized personnel, product contamination or spoilage, including the presence of foreign objects, substances, chemicals, or residues introduced during the growing, packing, storage, handling or transportation phases. The Company cannot be sure that consumption of its products will not cause a health-related illness in the future or that it will not be subject to claims or lawsuits relating to such matters. Even if a product liability claim is unsuccessful, the negative publicity surrounding any assertion that the Company’s products caused illness or injury could adversely affect the Company’s reputation with existing and potential customers and its brand image.

We may incur substantial costs enforcing or acquiring intellectual property rights and defending against third-party claims as a result of litigation or other proceedings.

We may incur substantial costs enforcing or acquiring intellectual property rights and defending against third-party claims as a result of litigation or other proceedings. In connection with the enforcement of our own intellectual property rights, the acquisition of third-party intellectual property rights or disputes related to the validity or alleged infringement of third-party intellectual property rights, including patent rights, we may be subject to claims, negotiations or complex, protracted litigation. Intellectual property disputes and litigation may be costly and can be disruptive to our business operations by diverting attention and energies of management and key technical personnel, and by increasing our costs of doing business. If we fail to prevail in any future litigation and disputes, it could adversely affect our results of operations and financial condition. Third-party intellectual property claims asserted against us could subject us to significant liabilities, require us to enter into royalty and licensing arrangements on unfavorable terms, prevent us from assembling or licensing certain of our products, subject us to injunctions restricting our sale of products, cause severe disruptions to our operations or the marketplaces in which we compete or require us to satisfy indemnification commitments with our customers, including contractual provisions under various license arrangements. In addition, we may incur significant costs in acquiring the necessary third-party intellectual property rights for use in our products. Any of these could seriously harm our business.

If we are unable to obtain patent protection for our products or otherwise protect our intellectual property rights, our business could suffer.

Our success depends, in part, on our ability to obtain patent protection for or maintain as trade secrets our proprietary products, technologies and inventions and to maintain the confidentiality of our trade secrets and know‑how, operate without infringing upon the proprietary rights of others and prevent others from infringing upon our business proprietary rights. Despite our efforts to protect our proprietary rights, it is possible that competitors or other unauthorized third parties may obtain, copy, use or disclose our technologies, inventions, processes or improvements. We cannot assure you that any of our existing or future patents or other intellectual property rights will be enforceable, will not be challenged, invalidated or circumvented, or will otherwise provide us with meaningful protection or any competitive advantage. In addition, our four pending patent applications may not be granted. If our patents do not adequately protect our technology, our competitors may be able to offer products similar to ours. Our competitors may also be able to develop similar technology independently or design around our patents, and we may not be able to detect the unauthorized use of our proprietary technology or take appropriate steps to prevent such use. We may need to enter into intellectual property license agreements in the future, and if we are unable to obtain these licenses, our business could be harmed. Any of the foregoing events would lead to increased competition and lower revenues or gross margins, which could adversely affect our operating results.

Confidentiality agreements with employees and third parties may not prevent unauthorized disclosure of trade secrets and other proprietary information, and our inability to maintain the confidentiality of that information, due to unauthorized disclosure or use, or other event, could have a material adverse effect on our business.

In addition to the protection afforded by patents, we seek to rely on trade secret protection and confidentiality agreements to protect proprietary know-how that is not patentable or that we elect not to patent, processes for which patents are difficult to enforce, and any other elements of our product discovery and development processes that involve proprietary know-how, information, or technology that is not covered by patents. Trade secrets, however, may be difficult to protect. We seek to protect our proprietary processes, in part, by entering into confidentiality agreements with our employees, consultants, advisors, contractors and collaborators. Although we use reasonable efforts to protect our trade secrets, our employees, consultants, advisors, contractors, and collaborators might intentionally or inadvertently disclose our trade secret information to competitors. In addition, competitors may otherwise gain access to our trade secrets or independently develop substantially equivalent information and techniques. Furthermore, the laws of some foreign countries do not protect proprietary rights to the same extent or in the same manner as the laws of the United States. As a result, we may encounter significant problems in protecting and defending our intellectual property both in the United States and abroad. If we are unable to prevent unauthorized material disclosure of our intellectual property to third parties, or misappropriation of our intellectual property by third parties, we will not be able to establish or maintain a competitive advantage in our market, which could materially adversely affect our business, operating results and financial condition.

Our business could be negatively impacted by cyber security threats, attacks and other disruptions.

We face advanced and persistent attacks on our information infrastructure where we manage and store various proprietary information and sensitive/confidential data relating to our operations. These attacks may include sophisticated malware (viruses, worms, and other malicious software programs) and phishing emails that attack our products or otherwise exploit any security vulnerabilities. These intrusions sometimes may be zero-day malware that are difficult to identify because they are not included in the signature set of commercially available antivirus scanning programs. Experienced computer programmers and hackers may be able to penetrate our network security and misappropriate or compromise our confidential information or that of our customers or other third-parties, create system disruptions, or cause shutdowns. Additionally, sophisticated software and applications that we produce or procure from third-parties may contain defects in design or manufacture, including “bugs” and other problems that could unexpectedly interfere with the operation of the information infrastructure. A disruption, infiltration or failure of our information infrastructure systems or any of our data centers as a result of software or hardware malfunctions, computer viruses, cyber-attacks, employee theft or misuse, power disruptions, natural disasters or accidents could cause breaches of data security, loss of critical data and performance delays, which in turn could adversely affect our business.

Security breaches of confidential customer information or confidential employee information may adversely affect our business.

Our business requires the collection, transmission and retention of large volumes of customer and employee data, and other personally identifiable information, in various information technology systems that we maintain and in those maintained by third parties with whom we contract to provide services. The integrity and protection of that customer and employee data is critical to us. The information, security and privacy requirements imposed by governmental regulation are increasingly demanding. Our systems may not be able to satisfy these changing requirements and customer and employee expectations, or may require significant additional investments or time in order to do so. A breach in the security of our information technology systems or those of our service providers could lead to an interruption in the operation of our systems, resulting in operational inefficiencies and a loss of profits. Additionally, a significant theft, loss or misappropriation of, or access to, customers’ or other proprietary data or other breach of our information technology systems could result in fines, legal claims or proceedings.

Risks Related to Our Industry

Failure to obtain necessary permits or otherwise comply with USDA regulations and requirements could result in a ban or temporary suspension of our ability to grow, manufacture or market our products as organic, and thus could materially adversely affect our business.

As a producer and distributor of food products, we are subject to the laws and regulations in the jurisdictions where our facilities are located and where our products are distributed. In particular we are subject to the Federal Food, Drug and Cosmetic Act, as amended by the Food Safety Modernization Act in 2011 (the “FSM Act”), which is enforced by the FDA. The FDA has the authority to regulate the growing, harvesting manufacture, including composition and ingredients, processing, labeling, packaging import, distribution and marketing and safety of food in the United States. The FSM Act significantly enhances the FDA’s authority over various aspects of food regulation. For example, the FSM Act granted the FDA mandatory recall authority when the FDA determines there is a reasonable probability that a food is adulterated or misbranded and that the use of, or exposure to, the food will cause serious adverse health consequences or death to humans or animals. While the FDA has been active in implementing the requirements of the FSM Act through issuance of regulations designed to result in a reduction of the risk of contamination in food manufacturing, the full impact of the FSM Act is not yet known, and we cannot assure you that it will not materially impact our business. Regulatory agencies in other jurisdictions have similar authority to address the risk of contamination or adulteration, and to require that contaminated products be removed from the market. The failure to comply with these laws and regulations in any jurisdiction, or to obtain required approvals, could result in a ban or temporary suspension on the production of our products or limit or bar their distribution, and affect our development of new products, and thus could materially adversely affect our business and operating results. In addition, the United States Department of Agriculture (the “USDA”), regulates the import and export of certain fruits and vegetables into and from the United States, and the USDA also imposes growing, manufacturing and certification requirements for certain products labeled with organic claims. Failure to obtain necessary permits or otherwise comply with USDA regulations and requirements could result in a ban or temporary suspension of our ability to grow, manufacture or market our products as organic, and thus could materially adversely affect our business.

The Company’s improper use of hydroponic farming methods may significantly impact the Company’s ability to maintain its operations and may adversely affect its financial results.

The Company’s improper use of indoor hydroponic farming techniques may adversely impact its operating results. For example, hydroponic farming commingles the use of water and electricity in close proximity which, if combined, may cause an electric shock or a power outage. As the nutrients supply in a hydroponic garden is powered by electricity, an outage could be detrimental to the garden. If an outage occurs, and lasts for a considerable period of time, the plants may die out if a supplementary system of nutrition is not implemented.

Hydroponic farming also necessitates proactive disease management practices to protect against pests and other natural conditions, outside of the control of the Company, from spreading through water sources. If the Company fails to properly manage its hydroponic farms, its operations and financial results may be adversely affected.

The Company is subject to fluctuations in market price and demand for agricultural products.

Fresh produce is highly perishable and generally must be brought to market and sold soon after harvest. The selling price received for the Company’s products may depend on a variety of factors, including timing of the sale, the availability and quality of the produce item in the market, and the availability and quality of competing produce.

In addition, general public perceptions regarding the quality, safety, or health risks associated with particular food products could reduce demand for some of the Company’s products. Food safety warnings, advisories, notices, and recalls, such as those administered by the FDA, the Center for Disease Control and Prevention, other federal/state government agencies, could also reduce demand. To the extent that consumers evolve away from products that the Company produces for health, food safety or other reasons, and the Company is unable to modify the product or to develop products that satisfy new consumer preferences, there will be a decreased demand for the Company’s products.

The Company’s results may vary from quarter to quarter depending on seasonal fluctuations related to the sale of the Company’s products.

Earnings may be affected by seasonal factors, including the availability, quality, and price of raw materials, the timing and effects of ripening and perishability, the ability to process perishable raw materials in a timely manner, the leveraging of certain fixed overhead costs during off-season months, and the slight impacts on consumer demand based on seasonal and holiday timing. Because we grow our products, the expenses incurred to meet consumer demand are often incurred in advance of the revenue earned by selling the herbs and lettuce. For example, we begin sowing our longest-growing crop 13 to 14 weeks in advance of delivery . The impact of seasonal demand and the sales cycle for our products may cause our results to vary from quarter to quarter, which may make an investment in us less attractive to some investors.

Increases in commodity or raw product input costs, such as fuel, packaging materials, could increase costs significantly.

The Company’s costs are determined in part by the prices of fuel and packaging materials. The Company may be adversely affected if sufficient quantities of these materials are not available. Additionally any significant increase in the cost of these items could also materially and adversely affect the Company’s operating results.

Specifically, the Company requires significant quantities of fuel for delivery vehicles and thus is exposed to the risks associated with fluctuations in the price for fuel. The price and supply of fuel can fluctuate significantly based on international, political, and economic circumstances, as well as other factors outside of the Company’s control.

Government policies and regulations specifically affecting the agricultural sector and related industries could adversely affect the Company’s operating results.

As a manufacturer of consumable products, the Company’s operations are subject to extensive regulation by various federal government agencies, including the FDA, the USDA and the Federal Trade Commission (“FTC”), as well as state and local agencies, such as the New Jersey Department of Agriculture, with respect to production processes, product attributes, packaging, labeling, storage, and distribution. Under various statutes and regulations, these agencies prescribe requirements and establish standards for safety, purity, and labeling. In addition, the advertising for the Company’s products is subject to regulation by the FTC, and the Company’s operations are subject to certain health and safety regulations, including those issued under the Occupational Safety and Health Act. Failure to comply with existing or modified regulations promulgated by these agencies may adversely affect the Company’s operating results.

We face intense competition that could prohibit us from developing or increasing our customer base.

The indoor agriculture industry is highly competitive. We may compete with companies that have greater capital resources and facilities. More established companies with much greater financial resources which do not currently compete with us may be able to more easily adapt their existing operations to our line of business. Our competitors may also introduce new and improved products, and manufacturers may sell equipment direct to consumers. We may not be able to successfully compete with larger enterprises devoting significant resources to compete in our target market. Due to this competition, there is no assurance that we will not encounter difficulties in increasing revenues and maintaining and/or increasing market share. In addition, increased competition may lead to reduced prices and/or margins for products we sell.

Risks Related to this Offering and Ownership of our Securities

Investors in this offering will experience immediate and substantial dilution in the book value of their investment.

The public offering price will be substantially higher than the net tangible book value per share of our outstanding shares of common stock. As a result, investors in this offering will incur immediate dilution of $ per share based on the assumed public offering price of $ per share. Investors in this offering will pay a price per share that substantially exceeds the book value of our assets after subtracting our liabilities. See “Dilution” for a more complete description of how the value of your investment will be diluted upon the completion of this offering.

The public offering price of our common stock may have little or no relationship to the historical book value of our common stock or the implied value of our common stock in prior financing transactions.

Prior to the listing of our common stock, our shares have not been listed on any stock exchange or other public trading market, but we have issued options, SAFEs, warrants and convertible notes that are exercisable for or convertible into shares of our common stock. However, our historical book value and the exercise or conversion prices of the options, SAFEs, warrants and convertible notes may have little or no relation to broader market demand for our common stock and thus the public offering price in this offering and the public trading price of our common stock on the Nasdaq once trading begins, provided that our common stock is approved for listing on Nasdaq. As a result, you should not place undue reliance on these historical prices as they may differ materially from the public offering price in this offering.

Our management will have broad discretion over the use of the proceeds we receive in this offering and might not apply the proceeds in ways that increase the value of your investment.

Our management will have broad discretion over the use of our net proceeds from this offering, and you will be relying on the judgment of our management regarding the application of these proceeds. Our management might not apply our net proceeds in ways that ultimately increase the value of your investment. We expect to use the net proceeds from this offering for the construction and/or acquisition of existing greenhouses, working capital, organizational build out, including the hiring of a chief operating officer, chief marketing officer, head of sales, and support and operational staff, debt repayment, transaction bonuses for our executive officers and general corporate purposes. Our management might not be able to yield a significant return, if any, on any investment of these net proceeds. You will not have the opportunity to influence our decisions on how to use our net proceeds from this offering.

Concentration of ownership among related parties, including our existing executive officers and directors, may prevent new investors from influencing significant corporate decisions.

Currently, our executive officers and directors collectively own 71.2% of our outstanding shares of common stock. Sament, an affiliate of our predecessor and one of our creditors, owns 20% of our outstanding common stock.